QuickBooks for Projects or Non-Profit Organisations

“We help you take care of your finances while you change the world.”

Research Projects, Donor Funded Projects, Associations, Non-Profits, Trusts, Churches, NGOs hold a very important place in Malawi and Africa at core. QuickBooks for Projects and Non-profit bears aspect of simplicity, which makes it easy for nonprofit organization’s executive and staff members to use. QuickBooks for non profits simplifies accounting processes, which are usually complicated in other Accounting software providers, making it easy to run the organizations or Projects. Through the detailed categorization and exemplary reporting on the expenditures of revenue, by Grant/Donation, Project or Program, the project management process is followed to the letter – this sees the organizations achieve groundbreaking success, and secure the survival and growth of the premises.

Nonprofit organizations can save time and work smarter with QuickBooks Desktop or Online Plus. It includes the features and functionality of QuickBooks and has features designed for projects and nonprofit organizations. QuickBooks is easy to learn and use. It simplifies the usually complicated accounting tasks that come with running a Projects and Nonprofit organization. Easily categorize and report on revenue expenditures by project or program, and create custom reports for each project or program. QuickBooks is fully customizable for your nonprofit.Using QuickBooks accounting software help to track and run report for NGOs or Projects financial data. You will get a brief overview of what a nonprofit is, learn how class tracking can help, and review the nonprofit/project specific reports.

Are you looking to purchase QuickBooks for your Projects or Non-Profit Organisation in Malawi? Would you like to speak with one of our Certified QuickBooks Pro Advisors about our QuickBooks?. We can help with choosing the right QuickBooks version, installation and setup, Customisation of the Chart of Account in line with project activities or budget format, QuickBooks training on how to move efficiently to save you time and setting up the reports to meet your needs. Speak to our Certified QuickBooks Pro Advisors +265999286696 or E-mail: sales@quickbooks.co.mw

How Projects and Non-Profits Use QuickBooks

“There is a special place in our hearts for projects that have the courage to stand for a good cause.”

Every Project, Non-Profit and Charitable organization is managing their accounting in one way or another. It’s important to be able to do these tasks efficiently and keep records reliably. One reason QuickBooks seems to be a good fit for nonprofits is because Intuit® has taken the time to ensure that it is not a square peg in a round hole by fitting into the nonprofit sector quite well.

Every Project, Non-Profit and Charitable organization is managing their accounting in one way or another. It’s important to be able to do these tasks efficiently and keep records reliably. One reason QuickBooks seems to be a good fit for nonprofits is because Intuit® has taken the time to ensure that it is not a square peg in a round hole by fitting into the nonprofit sector quite well.

Using Excel to run a Project or Non-Profit organisation on the surface look like a good fit, but there are a lot of issues because the tool is not purpose-built for the sector. That’s why QuickBooks is great for nonprofits and projects.

Non-Profit/Project accounting. As a nonprofit, you might be tracking the expenses of various programs and donations. QuickBooks understands this and has a function that automates this type of accounting. It makes it easy to separate those donations/grants and its related expenses. This keeps the team on the right track and on budget.

Tracking donations and grants. Donations are a big part a nonprofit’s work. Whether it is fundraising or allocating donor dollars, Euros, Pounds,etc QuickBooks has a function that enables the organization to do it easily. The program also works nicely with popular fundraising platforms to automatically sync those donations.

Reporting. There are a lot of groups nonprofits report to: boards, staff, donors and the general public. In fact, there’s always a unique audience to report the organization’s impact; using QuickBooks, staff can can pull reports for finances very easily, saving time and effort.

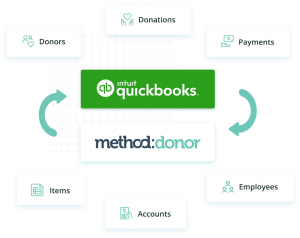

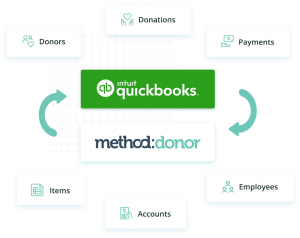

Integrated tools. Another great feature of QuickBooks for nonprofits is that it plays nice with other tools. Accounting software can be robust, but it can only do certain parts of the job. A nonprofit needs to do much more than just accept donations and account for them.

One of the biggest jobs a project or nonprofit does is to build strong, lasting relationships by making emails, phone calls, events and use other stewardship tools to accomplish this. The important part is to keep track of these interactions to truly strengthen relationships for years. That is why having a CRM is imperative for nonprofits. For functionality like this, QuickBooks relies on other nonprofit software, and information is passed between the programs seamlessly. That way, when someone makes a donation, it is tracked on a CRM focused on non-profits and accounted for properly on QuickBooks. This is an ideal solution!

QuickBooks Online is cloud-based. More and more, nonprofits are becoming decentralized. This means that there is a lot of work done outside of the office with remote workers, as well as volunteers and contractors. Whatever the case is, nonprofits are relying on cloud-based technology to have their workforce access information from wherever they are.This is of utmost importance when it comes to accessibility. QuickBooks offers cloud-based solutions as well. This means that information is made available as long as there is internet access. This makes it easier for everyone to work, collaborate and create impact from wherever they are in the world.

Automation. Automation is always an important point for technology. When monotonous processes are automated, individuals are more efficient. They have more time to do the work that really matters to them. QuickBooks automates a lot of the manual entry that would usually have to take place when doing accounting with pencil and paper. Donation Receipts are digital, so there is less fumbling around with old paperwork.Overall, it is just a cleaner experience.

What Qualifies a Business as a Non-Profit?

It can be any corporation, organization, or association with the mission to better help the general public. Each organisation should have its main purpose be the advancement of education or religion, literature, science, preventing cruelty to animals or children or women, or other charitable purposes. Some examples would include:

- Donor Funded Project(s)

- Churches

- Trusts

- Social welfare organizations

- Political Parties/ Organisations

- Charities

- An Association

Non-Profit organisation acquire their funds through donations or fundraising or awarded through grants or other fund sources. These accumulated monies must stay within the organisation to be used in the running and improvement of the project or mission. These funds may be spent on funding special programs and activities that the organisation provides, employees payroll, administration and operation expenses among other things.

Unique Features of QuickBooks Desktop-Non Profit.

There are a number of great features when choosing QuickBooks Premier 2020, Accountant 2020 or Enterprise-Nonprofit 20. The most important one is that the setup is geared to a non-profit’s specific needs. A non-profit will save time and efficiency when up to 30 users can simultaneously work within QuickBooks. Create a more secure data file designating user permissions for each user and give them the ability to only access the data they need. Non-Profit terminology will make the learning curve easier for those users familiar with the nonprofit industry. QuickBooks Desktop-Nonprofit can be further customized where needed to make it uniquely fit each Project or Programs. Class tracking can be used to further break down the income and expenses within categories like various Projects or Non-Profit programs. This makes reporting by project or program easier. Install the Non-Profit version and a number of great non-profit reports are already set up to use. Financial reports that can be delivered to the top board members or donors to assess project expenditure, financial management, activities completed etc.

Non-Profit terminology makes accounting tasks easier to learn

There are many instances of nonprofit terminology that are included in this version such as Donors, Donations, Pledges, Programs and Projects. For example, customers are donors, jobs are grants, invoices are used to track pledges and sales receipts are used for donations. Form templates, statements and reports all use the same nonprofit language for better understanding.

Save time from searching the menu lists for the most frequently used activities a nonprofit needs. Some of the customer, vendor, and banking activities under their own separate menu lists are all found together under one nonprofit menu list. You can create an invoice, receive a payment and make a deposit by using the Non-Profit menu list see below.

Every Project, Non-Profit and Charitable organization is managing their accounting in one way or another. It’s important to be able to do these tasks efficiently and keep records reliably. One reason QuickBooks seems to be a good fit for nonprofits is because Intuit® has taken the time to ensure that it is not a square peg in a round hole by fitting into the nonprofit sector quite well.

Every Project, Non-Profit and Charitable organization is managing their accounting in one way or another. It’s important to be able to do these tasks efficiently and keep records reliably. One reason QuickBooks seems to be a good fit for nonprofits is because Intuit® has taken the time to ensure that it is not a square peg in a round hole by fitting into the nonprofit sector quite well.